Do you want to learn how to build financial models from global experts in the industry?

Would you like the chance for your work on a course project to be reviewed by top professors and receive feedback on how they would improve your models?

If so, you’ll find the 10 best online courses for financial modelling on this page currently being offered by the top business schools in the world.

Table of Contents

Best Online Course for Financial Modelling

Fundamentals of Quantitative Modeling

The Wharton Business School has been teaching MBA students how to create financial models for decades, and now they are opening up their world-class education to the general public. If you’re looking for a good entry-level course that will give you the skills you need to build financial models, then this course will be a good fit.

This online course is not only a great way to learn about financial modeling, but also a fun experience that lets you work at your own pace and feel like an insider by learning from one of the best business schools in America.

By enrolling in this online class you will gain access to all 4 modules which include linear regression, probabilistic models, regression analysis, and much more. And there are hours of video content available in each module along with quizzes and interactive lessons.

Plus, you’ll be able to complete this course with ease if you have basic knowledge of Excel functions and formulas. Which makes this course a perfect starting point for a beginner or intermediate level student who wants to get started learning financial modelling.

Click Here to Enroll in Wharton’s Fundamentals of Quantitative Modeling

Business and Financial Modeling Specialization

The Wharton Business and Financial Modeling Specialization is a 6-month online course that will teach you how to effectively use spreadsheets for financial modeling.

This course will give you the skills needed to be successful in today’s business world. For example, these skills are required by investment banks like JP Morgan Chase & Co., Goldman Sachs Group Inc., Bank of America Corp., UBS AG, Citigroup Inc., and many others.

Nearly half of the people who took this course transitioned into a new career, and one in five people reported getting a pay raise or promotion after they completed this specialization on Coursera.

If you’re looking for a career in finance or even just want to improve your Excel spreadsheet skills, then look no further. This course will teach you everything from scratch – from basic formulas all the way up through advanced topics such as Monte Carlo simulations and real-world corporate analysis.

Best of all, you can complete this specialization on your own time at home or at work since it’s 100% online.

Click Here to Enroll in Wharton Business and Financial Modeling Specialization

Finance & Quantitative Modeling for Analysts Specialization

Quantitative modeling is a critical skill for business professionals. It’s also one of the most difficult topics to master because it requires both mathematical and financial skills that are often taught in separate courses.

This specialization will teach you quantitative modeling in an integrated way, using real-world examples from finance and accounting to teach you key concepts like risk management, corporate finance, and portfolio analysis.

You will build your knowledge through short videos, interactive exercises, quizzes, and assessments with time-saving shortcuts along the way

In just four months (or less), you’ll gain a solid understanding of how models are developed; be able to use spreadsheets as tools for analyzing data, and understand how decisions made by managers impact businesses financially – all without needing any advanced math skills beyond basic arithmetic.

Click Here to Enroll in Wharton’s Finance & Quantitative Modeling for Analysts Specialization

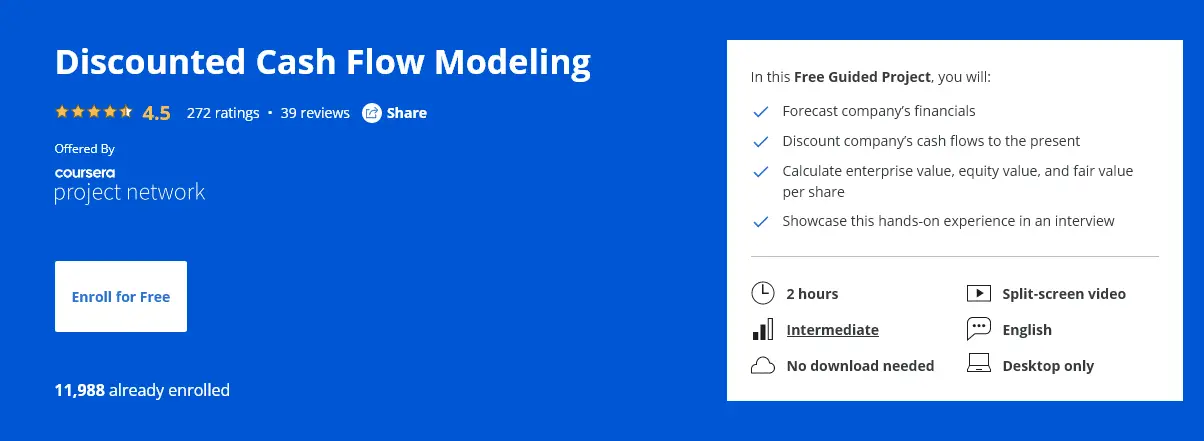

Discounted Cash Flow Modeling

Discounted Cash Flow Modeling is an online, self-paced course that will teach you the fundamentals of DCF analysis. You’ll learn step by step how to calculate a company’s value using DCF and other valuation methods.

This course will help you become more confident when valuing companies for investment purposes or M&A transactions. It also provides a great foundation for understanding the financial statements and ratios used in business valuations.

The best part about this course is that it’s completely online – no need for traveling or sitting through lectures. Plus, it comes with free lifetime access so you can take your time going through all the lessons at your own pace.

Click Here to Enroll in Discounted Cash Flow Modeling

Fundamentals of Financial Mathematics and Capital Budgeting

The Fundamentals of Financial Mathematics and Capital Budgeting is a comprehensive online course that will teach you the fundamentals of financial mathematics, including topics such as determinants of value, foundations of financial mathematics, and capital budgeting. You’ll also get an introduction to probability theory in this course.

This online course will teach you everything about financial modelling through easy-to-understand explanations, real-world examples, step-by-step tutorials, and quizzes so that even beginners can follow along easily.

By the end of this course, not only will you have mastered all of the main concepts behind financial modelling but also how to apply them in practice.

Click Here to Enroll in Fundamentals of Financial Mathematics and Capital Budgeting

Derivatives Markets: Advanced Modeling and Strategies

Derivatives Markets is a 12 Week online course designed by the MIT Sloan Business School specifically for traders and investors who are interested in learning advanced derivative pricing strategies that can be applied to complex investment strategies.

The course will cover topics such as advanced models for valuing exotic options; the application of credit risk analysis; and methods for modeling non-linear payoffs.

The goal of this course is not just to teach you about derivative valuation techniques but also to help you learn how they apply in practice so you can better manage your own trades and investments.

This course is excellent preparation for anyone planning to take the Chartered Financial Analyst Exam (CFA). It offers a well-balanced mix of the basics and advanced topics, which makes it perfect for any candidate seeking an edge over their competition.

Click Here to Enroll in MIT’s Derivatives Markets: Advanced Modeling and Strategies

Monetary Policy Analysis and Forecasting

The financial crisis of 2008 has raised a lot of questions about the role and functioning of central banks. It is now widely recognized that better understanding how monetary policy works can help us better prepare for future crises, and avoid making mistakes that could lead to another global financial meltdown.

This course will teach you everything you need to know about monetary policy analysis and forecasting at an advanced level, including practical implementations of monetary policy modelling in software such as MATLAB.

After you take this course you’ll be able to use this knowledge to interpret economic data on inflation, interest rates, exchange rates, etc., which means that you’ll be able to make more informed decisions when it comes time for your firm or organization’s top decision-makers to discuss “what if” scenarios involving potential changes in interest rate policies by the Fed or ECB.

Armed with this information, your company will have a much easier time adjusting its business strategy so as to not get caught off guard when big changes do occur in these key macroeconomic policies.

Click Here to Enroll in Monetary Policy Analysis and Forecasting

Pricing Options with Mathematical Models

Caltech’s Pricing Options with Mathematical Models is one of the best online courses for learning about mathematical models used in finance. It contains an introduction to basic probability theory, partial differential equations (PDEs) as applied to stock prices and interest rates, and the Black-Scholes option pricing model.

Pricing Options with Mathematical Models will present the financial models that are used to price options and other derivatives in the finance industry. In this course you will develop these models from scratch using a step-by-step approach, starting with basic probability theory.

Each module in this course will first introduce the concepts needed for pricing derivatives, then illustrate them in simple examples before moving on to more sophisticated applications of the same ideas.

The goal of this course is not only to provide an introduction to modern finance but also to give you some exposure to real-world problems encountered by practitioners in risk management and portfolio optimization.

By taking this course you’ll learn how mathematics can be applied directly as part of your job or business strategy – rather than just being taught as a theoretical subject divorced from reality.

Click Here to Enroll in Caltech’s Pricing Options with Mathematical Models

Financial Analysis of Insurance Companies

Insurance is a very complex industry and it’s hard to know where to start when you’re trying to get a good understanding of how the insurance business works.

This course will take you from the beginner level all the way through advanced financial modelling techniques so that by the end, you’ll be able to model any aspect of an insurance company.

This course on the financial analysis of insurance companies will help you understand the key elements of an insurance company, including the operating cycle and financial statement analysis. You’ll learn about accounting standards used by insurers as well as how to identify potential red flags in your own company’s financial statements.

Click Here to Enroll in Financial Analysis of Insurance Companies

Professional Certificate in Essential Quantitative Business Skills

This Professional Certificate in Quantitative Business Skills will provide you with the essential tools for making effective business decisions using quantitative methods. You’ll learn how to analyze a companies performance, evaluate investment opportunities, and predict future trends in a way that’s easy for anyone to understand who has taken basic math classes in high school or college.

Each of the three courses in this specialization will provide an introduction into the field of finance and they will teach you about key concepts like risk management, statistics, regression analysis, forecasting techniques, and more.

By taking all three courses together in this Financial Modelling specialization you’ll get a comprehensive overview of financial modeling as well as hands-on practice working with real-life case studies.

Click Here to Enroll in Professional Certificate in Quantitative Business Skills